Use Cases

Didactics

Constructive Game-Based Learning

Constructive Game-Based Learning (GBL) merges constructivist principles with gamification to create engaging educational experiences. This approach fosters active learning, enabling students to build knowledge through exploration.

Ethical Aspects in the field of Gamification and Finance

Based on the work of Nespolo (2024) this use case addresses ethical aspects in the context of gamification and Game-Based Learning in Finance. First, the topic is discussed in general and thereafter more specific in the context of a Portfolio Management Simulation.

Game Development

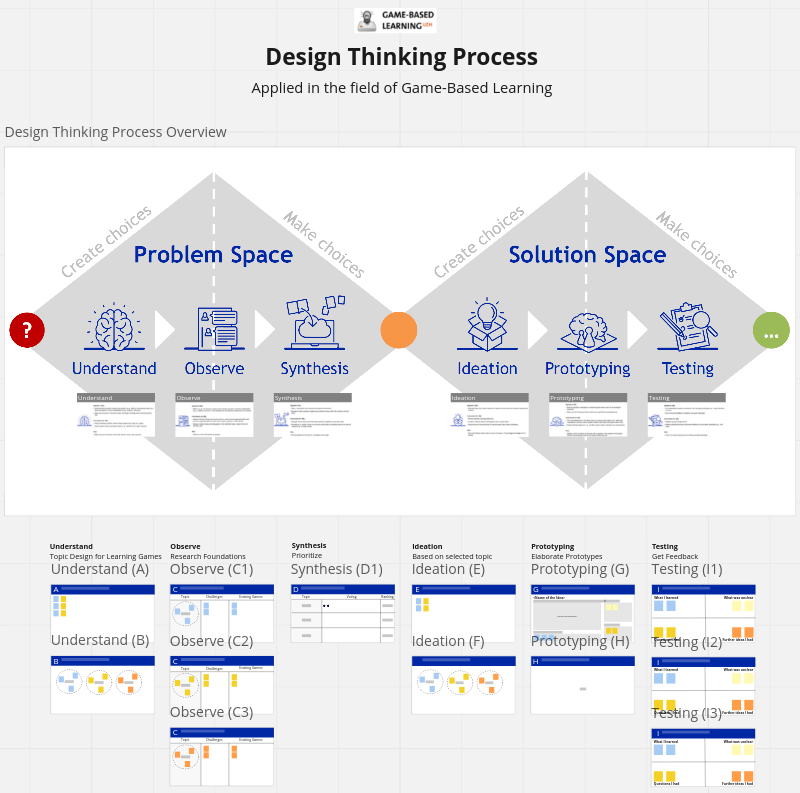

Design Thinking for Game-Based Learning

Design Thinking provides a way to face dynamic, multifaceted challenges, by using a creative and collaborative process. In this use case, the Design Thinking Process is being applied to elaborating game ideas and prototypes.

Developing Digital Educational Escape Rooms

The development process of a hybrid escape room respectively scavenger hunt, where a captivating plot meets challenging riddles set at the University of Zurich. By leveraging this escape room platform, educators can craft their own escape room.

Simulations

A Business Simulation in Use

In today's dynamic business landscape, effective financial management is a key element for organizational success. This immersive business simulation offers a unique opportunity to delve into the world of corporate finance, providing participants with a risk-free environment to improve their decision-making skills and gain a comprehensive understanding of financial strategies.

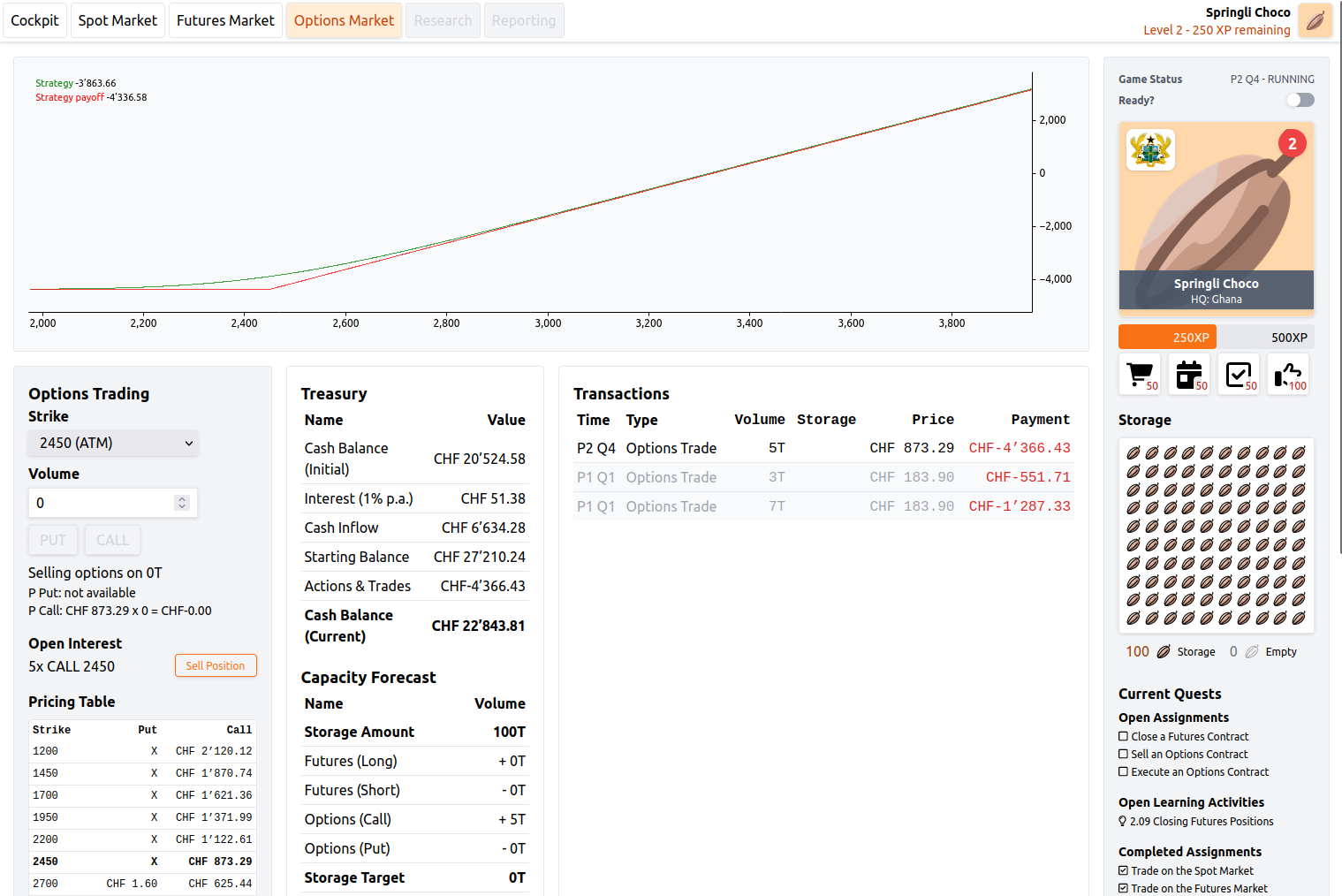

Derivatives Game in Use

How participants experience the challenging topic derivatives in a Game-Based Learning setting. The Derivatives Game teaches students the difference between a purchase today and a sure or possible purchase tomorrow.

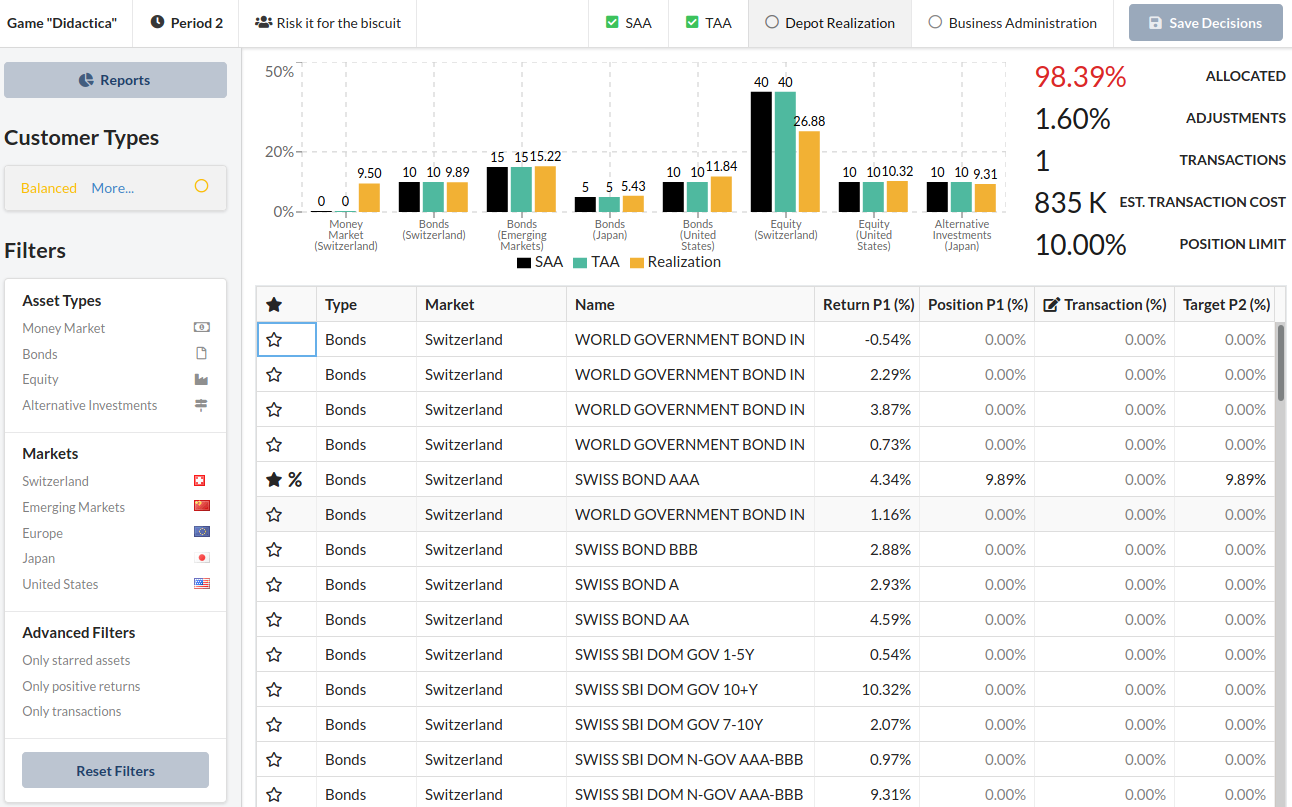

Portfolio Management Simulation In Use

Learning portfolio management by managing a portfolio is possible with our in-house developed Portfolio Management Game. This use case describes how the players can apply their knowledge of finance and macroeconomics in a portfolio management setting.

StartInvest in Use

In today's dynamic business landscape, effective financial management is a key element for organizational success. This immersive business simulation offers a unique opportunity to delve into the world of corporate finance, providing participants with a risk-free environment to improve their decision-making skills and gain a comprehensive understanding of financial strategies.