Portfolio Management Simulation

A simulation to improve decision-making ability

In the Portfolio Management Game you and your team take on the role as a manager of a bank’s portfolio management and compete with different teams. Based on a Web-based Simulation, the entire investment process is simulated from the perspective of an asset manager using historical or fictitiously generated business cycles.

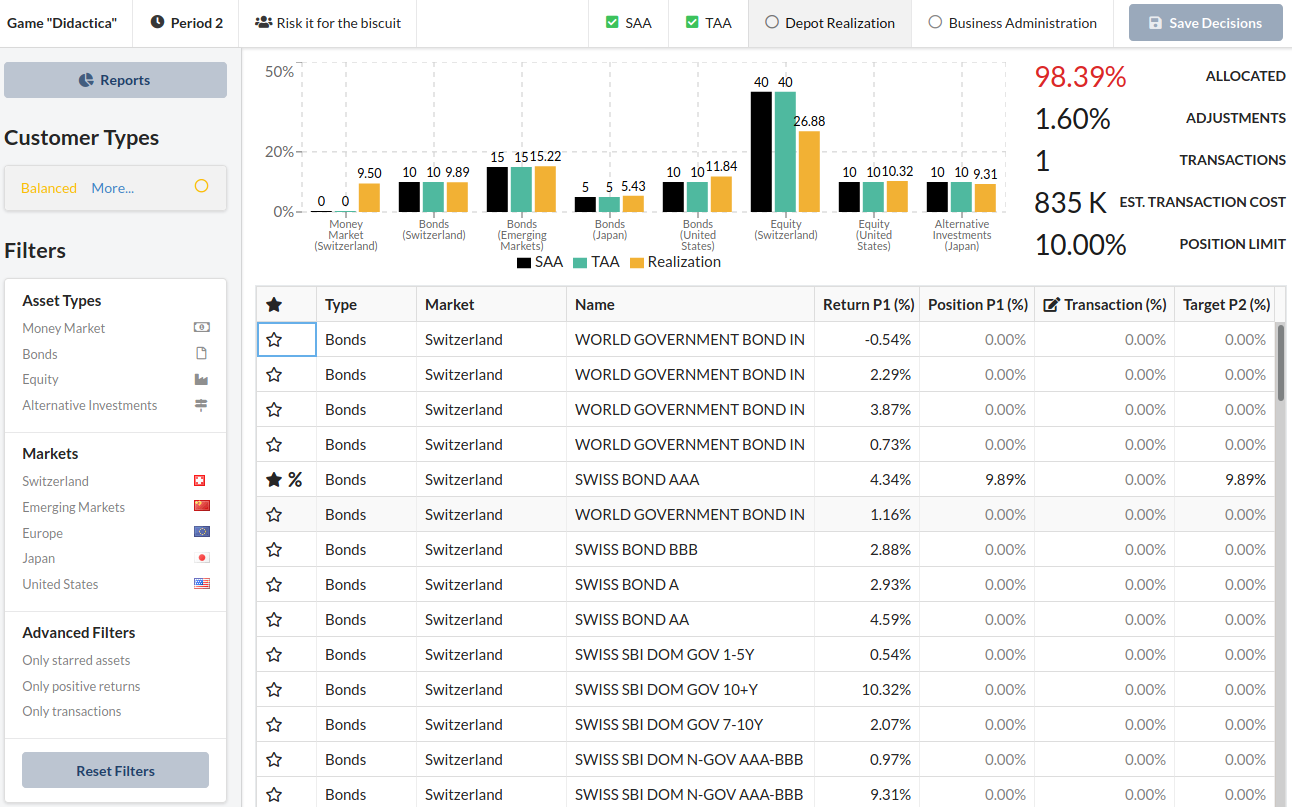

You will be assigned client types for whom you select suitable asset management mandates based on their respective needs. In a next step you formulate the investment strategy of the client's portfolios and work out both a strategic and tactical investment strategy. The latter is based on forecasts of the business cycle, which you receive at the beginning of every investment period.

Subsequently, the strategy will be implemented. You have to choose between active and passive management as well as a top-down or bottom-up approach and select the individual securities. The performance is measured and evaluated periodically. Decisions are made on the bank’s business factors such as conditions & fees, human resources, logistics and profit distribution.

Learning Objectives

- Players are able to apply their knowledge in finance and macroeconomics in a portfolio management setting.

- Players are able to construct a strategic asset allocation which covers the customer's needs.

- Players are able to construct a portfolio that fits to the strategic and tactical asset allocation.

- Players are able to analyze various financial ratios, draw conclusions and make tactical adjustments in the portfolio(s) based on macroeconomic forecasts.

- Players are able to present and explain their strategy, implementation decisions, and results to a specific target audience in a suitable and understandable way.

Imprint

Department of Finance, University of Zurich

Used In

Advanced Portfolio Management Game (S)